RoboStreet – January 26, 2023

Markets See Pressure Ahead of PCE and FOMC

Markets experienced a downturn this week, as tech giants such as Microsoft reported disappointing earnings and offered a bleak outlook. Investors will be closely monitoring the first reading on the fourth-quarter Gross Domestic Product (GDP) on Thursday to gauge the economy’s growth. Economists predict an increase of 2.3%, which is lower than the 3.2% increase in the third quarter, but still suggests a healthy economy. On Friday, Personal Consumption Expenditure (PCE) data for December will also be released, providing a key indicator of the economy’s overall performance.

The second-largest U.S. company by market capitalization, Microsoft, saw significant losses the day after its report was released, causing a decline in all three major U.S. indices on Wednesday. With the focus now firmly on Friday’s PCE data, it appears that earnings and the next FOMC decision will dictate the next market move.

With several earnings reports alarmingly showing poor numbers, we will now be waiting for Personal Consumption Expenditures (PCE) reports to provide further evaluation of the economy and the current state of inflation. For example, Boeing, despite reporting positive cash flow for two consecutive quarters, reported a loss in the fourth quarter–unexpected by analysts–and its stock saw a 0.3% decrease. Abbott Laboratories’ earnings beat Wall Street estimates, but a 12% drop in sales from the previous year led to a 2.1% decrease in stock value. Investors will also be closely watching Tesla’s earnings report after Wednesday’s close.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

The Federal Reserve is set to meet next week to make a decision on monetary policy and is expected to raise interest rates by one-fourth of a percentage point as it continues its transition towards gradual loosening. This has caused concern among investors that the Fed’s constant rate hikes could lead to a recession, especially as purchasing managers’ surveys revealed that the U.S. manufacturing and services industries have been contracting for seven consecutive months in January, fueling the possibility of a “hard landing.”

On Friday, the Personal Consumption Expenditure (PCE) figures for December will be released. Although there is no indication of any unexpected results, this report will play a major role in shaping the Federal Reserve’s and the market’s future actions.

Click Here To Subscribe To Our Youtube Channel, Don’t Miss Out!

Following the release of positive inflation data from both Europe and America, interest rates decreased while the value of the U.S. dollar remained stable. The yield on 10-year bonds is currently below 3.5%, a level that had previously been considered supportive, as sales figures did not meet expectations. Given this situation, I plan to capitalize on this opportunity by investing in a specific symbol and sector, more details will be provided later.

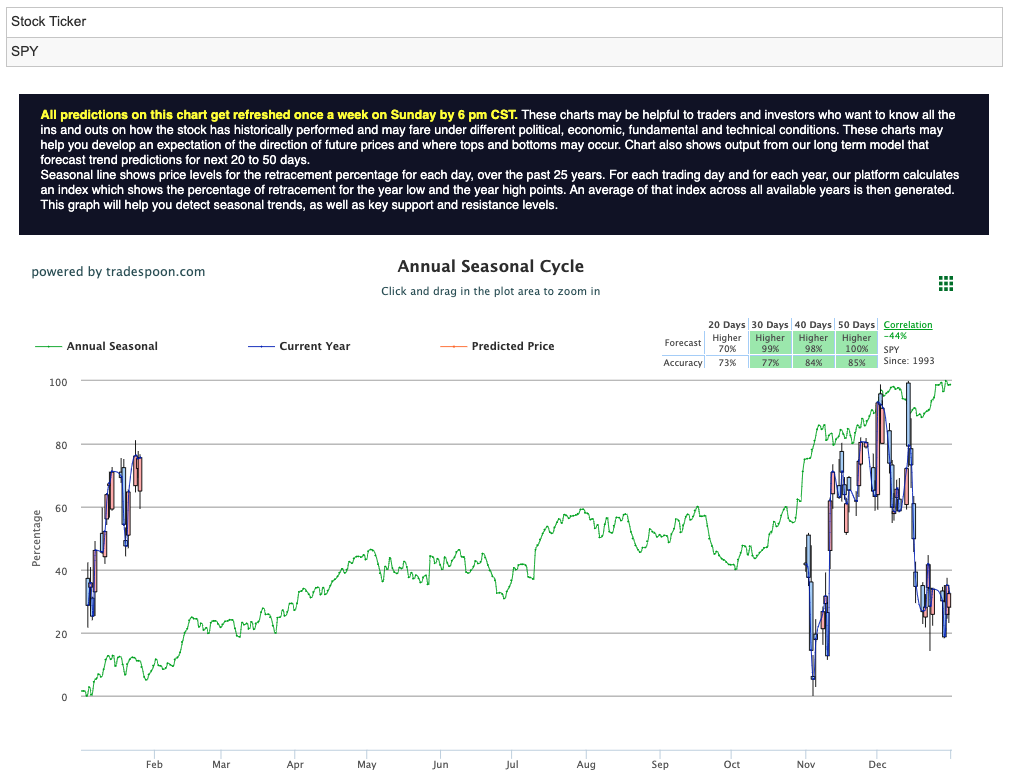

At present, the levels of resistance for the $SPY are at $402 and $416, with support levels at $396 and $391. Based on my analysis, I anticipate that the market will likely remain in a sideways trend for the next 2-8 weeks, leading me to maintain a neutral outlook at this time. Therefore, it is advisable to take measures to protect your positions by implementing hedging strategies.

If the bear market is to resume, there is one symbol I love to trade in order to stay ahead of market trends and profit in current conditions.

During times of market volatility, a particular type of investment tends to perform well. Despite a promising start to the year 2023, the market has recently shifted to a bearish trend. As various challenges arise, this industry may be facing difficulties in the near future, creating a prime opportunity to sell.

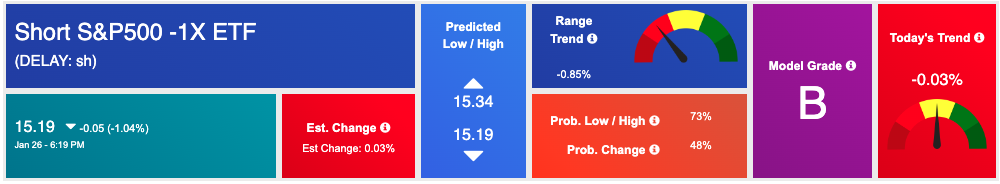

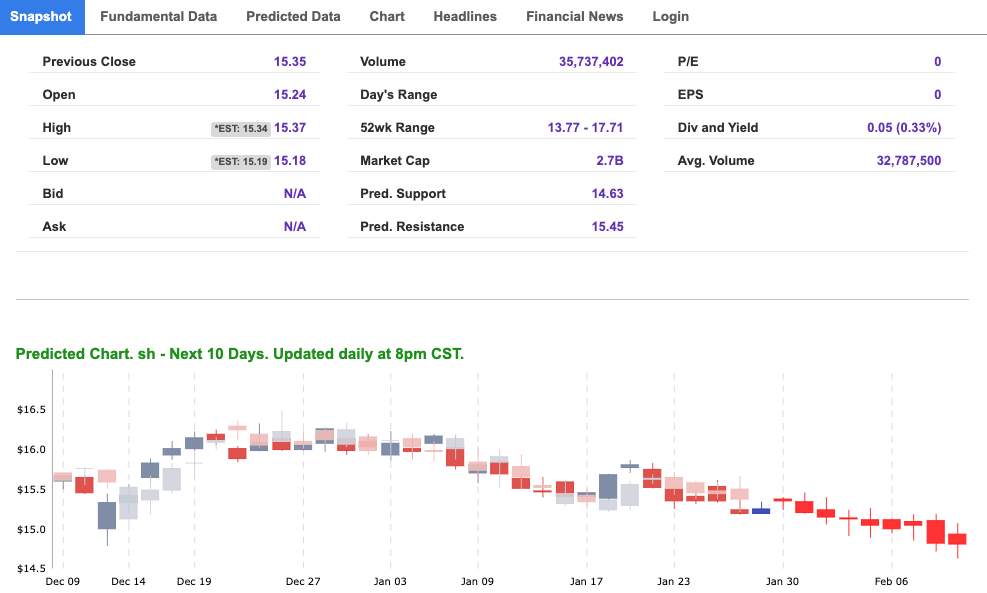

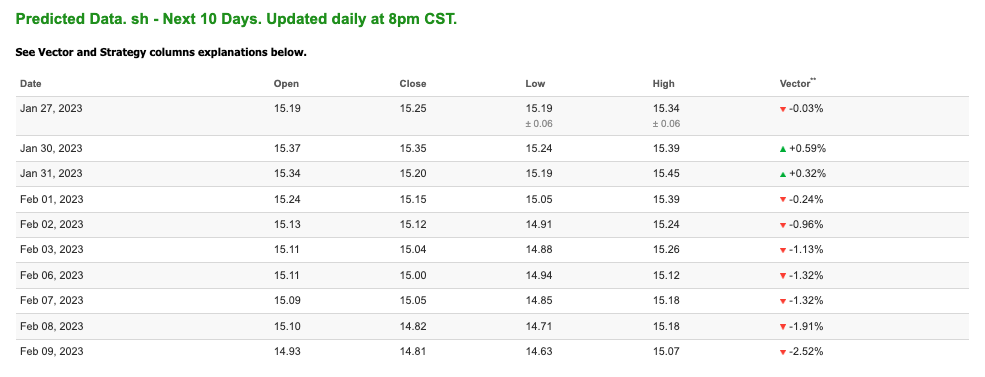

The ProShares Short S&P 500 ETF (SH) is a fund that bets against the S&P 500 index, and it is currently trading around the $15 level, lower than its 52-week high. The symbol’s value has been decreasing this week, making it a good time to purchase at a lower price. As the market is currently in a bearish phase, the Federal Reserve’s plan to raise interest rates to address inflation may cause additional market uncertainty. Given this scenario, I believe that the $SH has potential for growth in the upcoming weeks, and I will be adding it to my portfolio.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

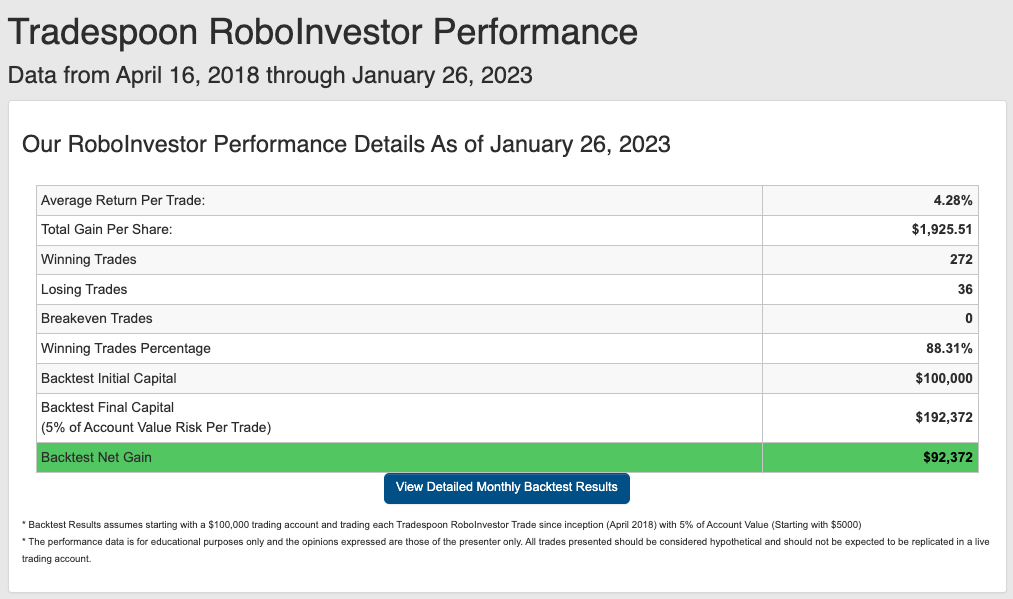

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

Click Here – To See Where I Put My RoboInvestor Money

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here To Subscribe To Our Youtube Channel, Don’t Miss Out!

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Original source: https://www.tradespoon.com/blog/a-i-alert-bear-market-must-have/