Unraveling the Secrets of JPMorgan: Why Investors Can’t Get Enough Amidst Market Turbulence

RoboStreet – March 21, 2024

In a much-anticipated move, the Federal Reserve opted to maintain interest rates unchanged following this week’s policy-setting meeting. The decision, widely expected by analysts, sparked a rally in the stock market, with all three major indexes notching record closing highs on Wednesday.

Despite recent mixed economic data, including higher readings on inflation over the past two months, Fed officials are sticking to their earlier forecast of cutting interest rates by three-quarters of a percentage point by the end of the year. However, they now project higher rates in the coming years, signaling a cautious approach to managing the economy.

“I’m investing my own money in every stock my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Thursday witnessed another surge in stock prices, although Apple experienced a dip after facing a broad antitrust lawsuit filed by the Justice Department and several states. On a brighter note, Reddit stock made a remarkable debut in trading, while Micron Technology shares soared following stellar earnings, providing a significant boost to the chip sector.

Micron’s quarterly profit surprise was attributed to surging demand for generative artificial intelligence, propelling the company’s performance in the three months ending Feb. 29. Moreover, the company’s fiscal third-quarter guidance exceeded Wall Street expectations, further bolstering investor confidence in the semiconductor giant’s prospects.

As the market reacts to economic indicators, last week’s Consumer Price Index (CPI) came in slightly higher than anticipated, contributing to a scenario where interest rates are trading at the upper range. The 10-year yield, currently at 4.3%, faces multi-month resistance, with implications for market sentiment. A yield above 4.35% is seen as bearish, signaling a hawkish stance from Fed Chair Powell, while a lower yield suggests the opposite.

Click Here To Subscribe To Our YouTube Channel, Don’t Miss Out!

Amidst these developments, value stocks continue to rally, buoyed by expectations of a normalization of the yield curve and a decrease in inflation. However, technology stocks have been lagging, with notable pullbacks observed in companies like NVDA, COST, and ADBE.

Market participants remain vigilant as Treasury markets experience heightened volatility, driven by recalibrations of rate cut probabilities and expectations regarding their timing and magnitude. Despite this turbulence, the prevailing sentiment suggests that the Fed is unlikely to raise rates further this year or the next, with a high probability of interest rate cuts in the first half of 2024. Such a narrative bodes well for the market, particularly in the context of the so-called “magnificent 7 stocks” like APPL and TSLA, which have seen dips below their 200-day moving averages.

As traders analyze market dynamics, there’s a noticeable shift away from mega-cap tech stocks towards value and high-beta stocks. Strong performers in energy, banks, materials, and industrials sectors are gaining attention amidst this rotation.

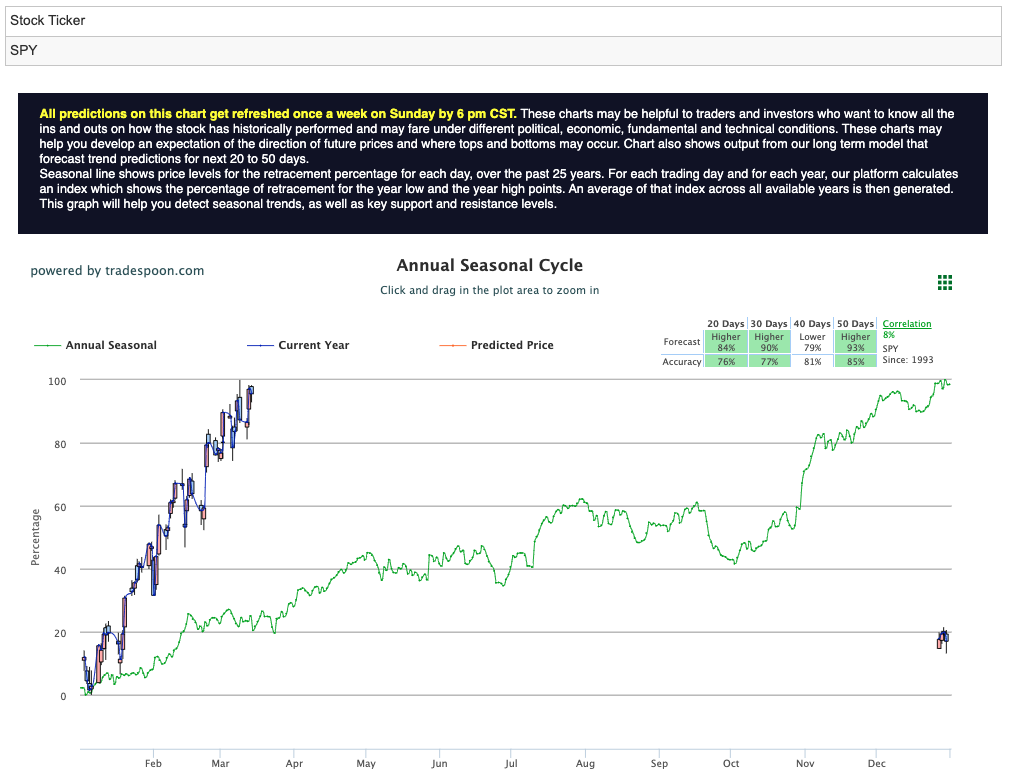

With market conditions perceived as overbought and mega-cap stocks consolidating, some investors are adopting a market-neutral stance, awaiting further cues from the Fed decision and March Options expiration. Nonetheless, bullish sentiments persist, albeit with caution, as patterns of higher highs and higher lows are expected to emerge in the coming weeks. However, there’s a consensus that the peak of the rally may have already been reached, with SPY likely to encounter resistance levels between $510-525, while short-term support is seen around 480-490 for the next few months. For reference, the SPY Seasonal Chart is shown below:

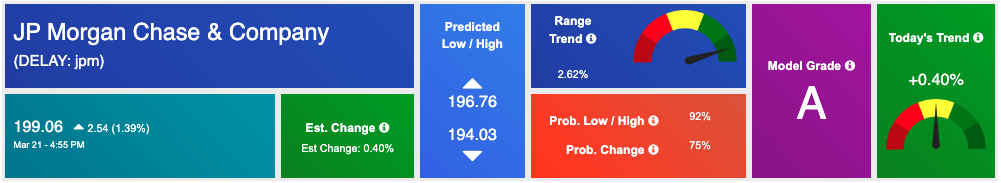

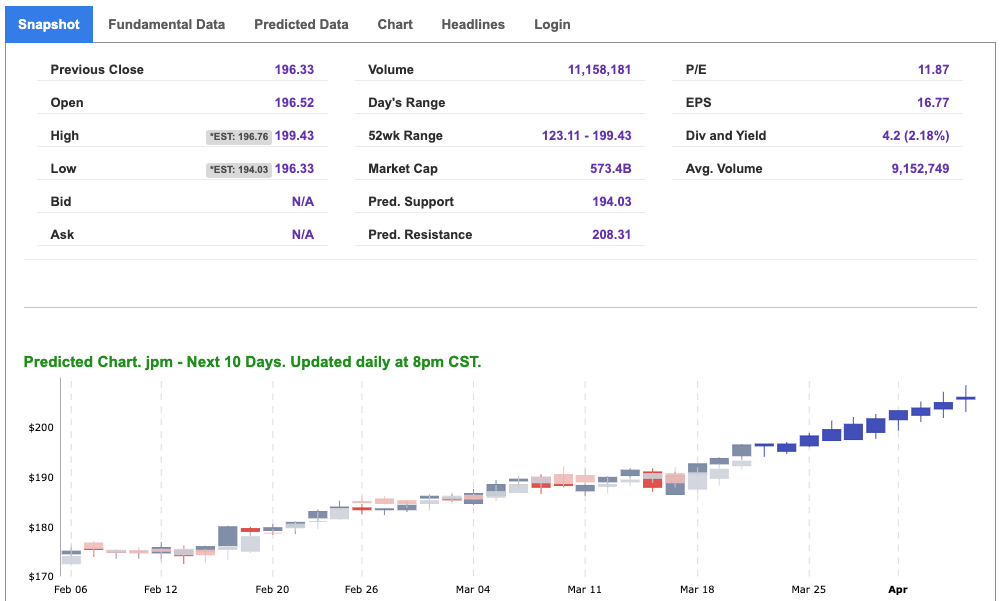

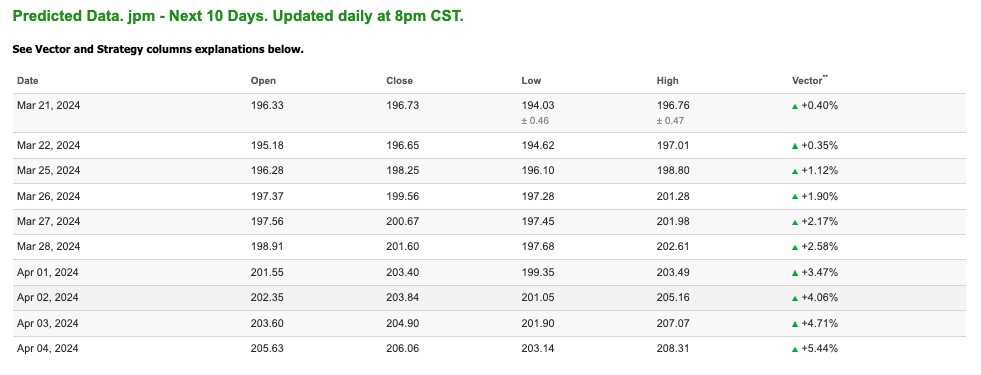

Looking at the above data, there is one symbol that stands out to me. JPMorgan Chase & Co. (JPM) holds a distinguished reputation as one of the world’s largest and most influential financial institutions. In the current market climate marked by volatility and shifting sentiments, JPMorgan emerges as a compelling investment opportunity due to several key factors.

Diversified Business Model: JPMorgan’s robust and diversified business model shields it from the impact of market fluctuations in any single sector. With operations spanning investment banking, wealth management, and commercial banking, the company is well-positioned to leverage its strengths across multiple segments to mitigate risks and capitalize on emerging opportunities.

Resilience in Uncertain Times: Navigating through various interest rate environments, JPMorgan has demonstrated resilience and adaptability, ensuring stability in its earnings. As interest rates remain a focal point of market discussions, the bank’s expertise and resources enable it to adjust strategies in response to changing monetary policies, thereby maintaining stability and resilience.

Value in Financials: Aligned with the market’s shift towards value stocks, JPMorgan presents an attractive proposition for investors seeking stability and growth potential. Amidst expectations of a normalization of the yield curve and decreasing inflation, the bank stands to benefit from renewed interest in the financial sector.

Strong Fundamentals: Despite macroeconomic uncertainties, JPMorgan maintains strong fundamentals, characterized by solid financial performance and a healthy balance sheet. Its ability to generate consistent revenues and effectively manage risks positions it as a reliable investment choice in turbulent market conditions.

Potential Catalysts: Factors such as the Federal Reserve’s stance on interest rates and economic indicators like inflation data serve as potential catalysts for JPMorgan’s stock performance. As market participants interpret and react to these variables, JPMorgan’s strategic positioning and operational excellence could drive positive momentum for its shares.

In summary, JPMorgan Chase & Co. emerges as a stalwart in the financial sector, offering investors stability, growth potential, and resilience amidst market uncertainties. With its diversified business model, solid fundamentals, and adept management, JPMorgan stands poised to weather market turbulence and deliver long-term value for its shareholders.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

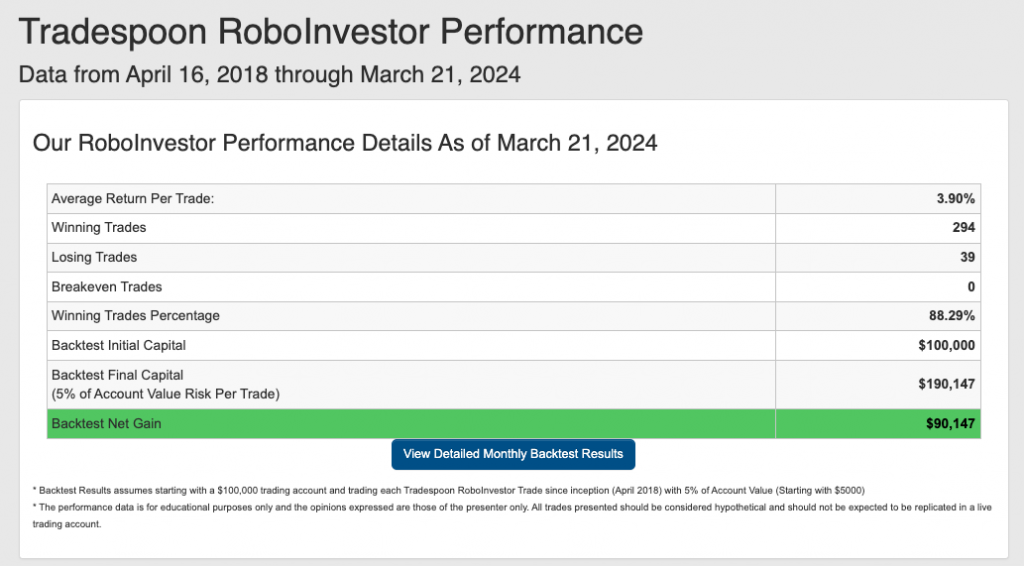

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.29% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Click Here – To See Where I Put My RoboInvestor Money

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here To Subscribe To Our YouTube channel, Don’t Miss Out!

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Original source: https://www.tradespoon.com/blog/federal-reserve-holds-interest-rates-steady-stocks-rally-to-record-highs/