Inflation Concerns Drive Market Volatility

RoboStreet – March 14, 2024

Amidst a flurry of economic data, the spotlight this week has been firmly fixed on the Consumer Price Index (CPI) and the Producer Price Index (PPI), with all eyes trained on the implications for interest rates. The results have sent ripples through the financial markets, shaping investor sentiment and strategy.

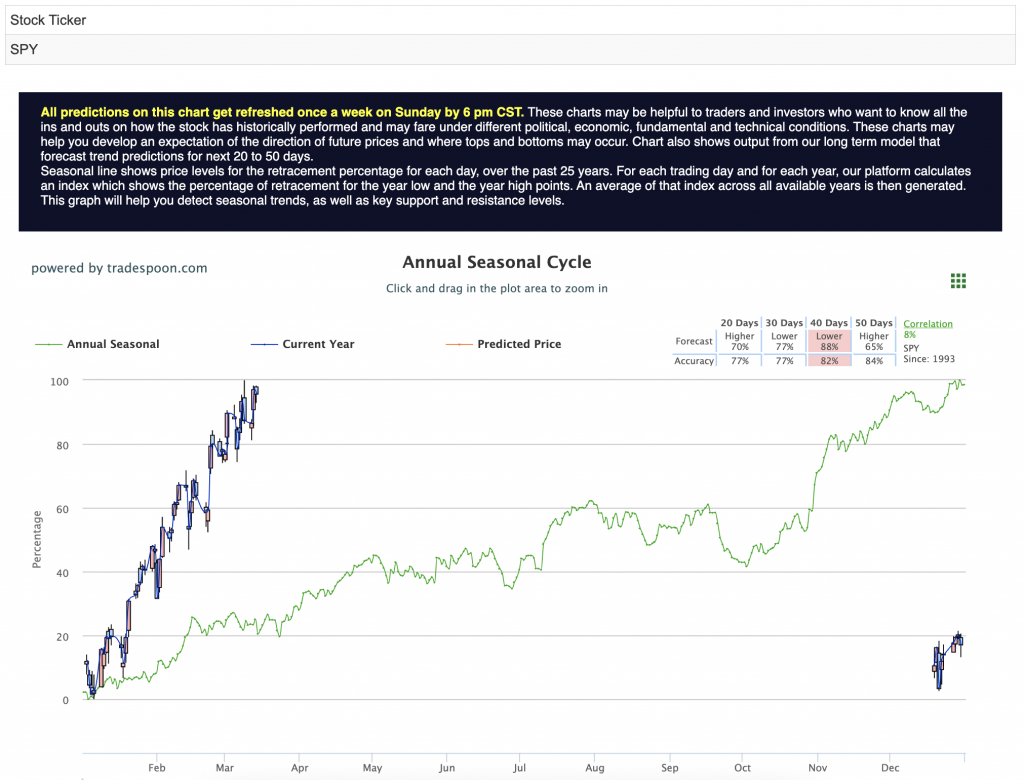

Let’s delve into the numbers: The CPI arrived slightly hotter than anticipated, setting off a chain reaction in yields, pushing them higher, and leading to a sideways trading pattern in the market. While the CPI figures hint at a potentially elevated inflationary environment, market analysts remain cautious, with many believing that the recent rally in the SPY (S&P 500 ETF) might find its peak around the $510-520 mark. Short-term support levels are seen at 480-490, indicating a cautious approach among investors for the next few months. To provide a visual reference, the SPY Seasonal Chart is presented below:

Turning to the PPI, the index surged by 0.6% on the month, doubling the estimates, and marking the most significant increase since September 2023. The bulk of this rise stemmed from a notable 1.2% surge in goods prices, primarily fueled by a 4.4% jump in energy costs. This surge in PPI adds weight to concerns about inflationary pressures within the economy.

“I’m investing my own money in every stock my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

On the flip side, retail sales saw a modest increase of 0.6%, falling slightly short of expectations, while weekly jobless claims dipped to 209,000. These figures underscore the delicate balance between economic growth and inflationary pressures.

Looking ahead, investor focus now shifts toward the March option expiration and the upcoming Federal Open Market Committee (FOMC) decision next week. The prevailing narrative suggests that value stocks are rallying on the premise of a normalized yield curve and diminishing inflationary fears. However, with both the CPI and PPI surpassing expectations, interest rates are at the upper echelons, with the 10-year yield hovering around 4.3%.

Click Here To Subscribe To Our YouTube Channel, Don’t Miss Out!

While the SPY and small-cap stocks continue to chart new all-time highs, the technology sector has shown signs of lagging, with notable pullbacks observed in stocks like NVDA, COST, and GE. Market participants are closely monitoring Treasury markets, which have been characterized by extreme volatility as investors reassess the likelihood and timing of rate cuts by the Federal Reserve.

Speaking of the Fed, prevailing market sentiment suggests that the central bank may halt its rate hike cycle for the remainder of the year and possibly initiate rate cuts in the first half of 2024. This outlook is perceived as bullish for the market, although any deviation from this narrative could trigger significant sell-offs, particularly in high-flying stocks.

Thursday saw stocks closing lower in response to the inflation report, with the PPI’s unexpected surge contributing to market jitters. As we approach the FOMC meeting, all eyes are on any indications regarding the timing and pace of potential rate cuts.

In other economic news, retail sales figures fell slightly short of expectations, while labor market data remained robust. Meanwhile, the International Energy Agency’s bullish outlook, coupled with geopolitical tensions, propelled crude oil futures to their highest level in over four months, underlining the intricate interplay between economic fundamentals and geopolitical factors.

In summary, the recent inflation data has injected a dose of uncertainty into the market, prompting investors to adopt a more cautious stance amidst concerns of overheating and potential policy shifts. As we navigate through these turbulent waters, the upcoming FOMC decision looms large, poised to shape the trajectory of the financial markets in the days to come. With these levels in mind, one symbol continues to catch my attention.

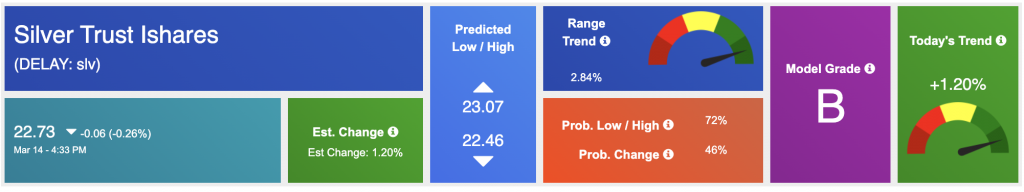

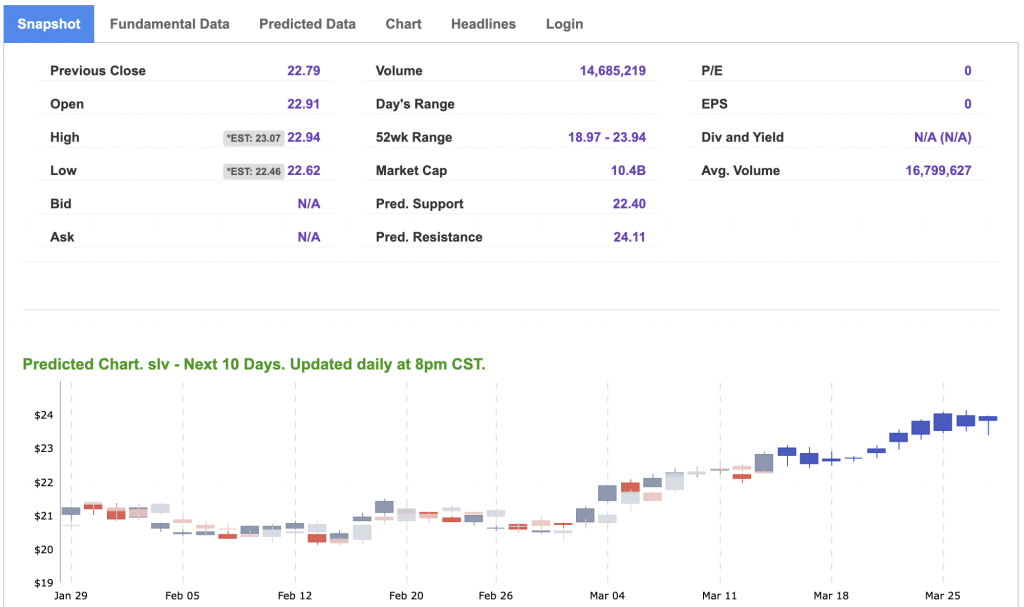

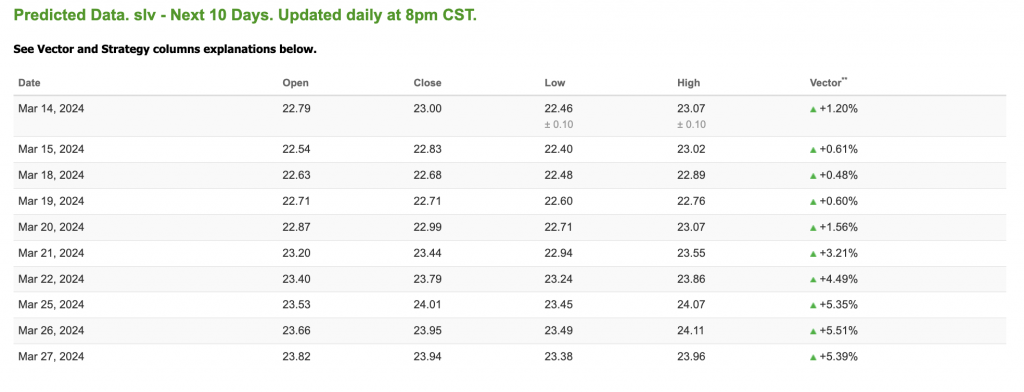

Silver Trust iShares (SLV) has been garnering attention amidst the recent market volatility. The iShares Silver Trust (SLV) offers investors exposure to the price movement of silver, making it an attractive option for those seeking to diversify their portfolios and hedge against inflationary pressures.

Silver’s intrinsic value as both a precious metal and an industrial commodity positions it uniquely amidst fluctuating market conditions. With its myriad industrial applications spanning electronics, renewable energy, and healthcare, silver enjoys robust demand fundamentals. Moreover, its status as a store of value and safe-haven asset during times of economic uncertainty further bolsters its appeal.

In the current market environment, characterized by concerns over inflationary pressures and interest rate dynamics, silver emerges as a compelling investment opportunity. The recent uptick in inflation, as evidenced by the CPI and PPI data, underscores the importance of preserving purchasing power and hedging against potential currency debasement.

Furthermore, silver’s industrial utility augments its investment thesis, particularly amidst the global transition towards clean energy technologies and digitalization. As the world pivots towards renewable energy sources and electric vehicles, silver’s role in critical components such as solar panels and batteries is set to expand, driving sustained demand growth.

From a technical standpoint, silver prices have exhibited resilience amid market volatility, with the SLV ETF reflecting this upward momentum. The metal’s ability to maintain its value amidst broader market fluctuations positions it favorably as a defensive asset in investors’ portfolios.

In summary, SLV presents a compelling investment opportunity in the current market landscape, offering diversification benefits, inflation-hedging properties, and exposure to burgeoning industrial demand trends. As investors navigate through uncertain terrain, silver shines bright as a beacon of stability and resilience, poised to deliver long-term value appreciation amidst evolving market dynamics.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

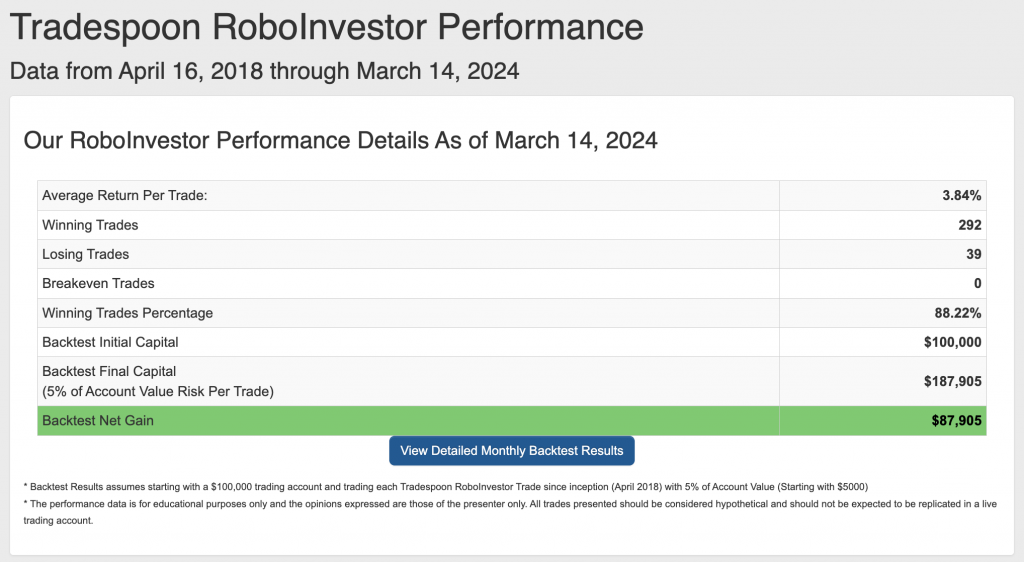

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.22% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Click Here – To See Where I Put My RoboInvestor Money

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here To Subscribe To Our YouTube channel, Don’t Miss Out!

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Original source: https://www.tradespoon.com/blog/from-market-mayhem-to-silver-lining-how-slv-etf-rescues-investors-in-times-of-crisis/