Silver (SLV) Review Amidst Changing Economic Landscape

RoboStreet – March 7, 2024

As financial markets continue to dance to the rhythm of economic indicators, the spotlight has recently shifted towards silver (SLV) amidst a flurry of developments. Unemployment data this week hinted at the intricacies of the labor market, but the overarching theme remains interest rates. With earnings season winding down, investors are now fixated on the looming CPI and PPI data releases next week.

Wednesday saw a surge in stock prices following Federal Reserve Chairman Jerome Powell’s reassuring remarks to Congress. Powell’s commitment not to hastily raise rates provided a breath of relief to investors. He emphasized the potential for interest-rate cuts this year, underscoring the Fed’s cautious stance towards achieving its inflation target.

“I’m investing my own money in every stock my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Despite acknowledging improvements in inflation and labor market dynamics, Powell remained vigilant, stressing the need for confidence in sustained progress before considering rate cuts. This dovish tone from the Fed has bolstered market sentiment, particularly among banking stocks like Wells Fargo ($WFC), which rallied on expectations of a normalized yield curve and diminishing inflationary pressures.

However, recent economic data, including higher-than-expected CPI and PPI figures, has kept interest rates at the upper end of the spectrum. The 10-year Treasury yield hovers around 4.3%, while the Dollar Index ($DXY) faces resistance between $105-107. The market’s optimism towards a soft landing scenario has propelled indices like the QQQ and small caps to record highs.

Moreover, sectors such as biotech, ARKK, and high-beta stocks are witnessing a resurgence, reflecting investors’ appetite for riskier assets. Yet, the Treasury market remains turbulent as participants recalibrate expectations around rate cuts.

Geo-political tensions, notably in the Red Sea with Houthi rebel activity, have contributed to a rebound in oil prices. The disruption to global shipping routes underscores the fragility of the energy market. Meanwhile, Bitcoin’s breakout above $65,000 underscores its resilience and growing acceptance as a long-term asset.

Click Here To Subscribe To Our YouTube Channel, Don’t Miss Out!

As market participants anticipate a dovish stance from the Fed, attention shifts to the forthcoming elections and the trajectory of Trump’s ratings. The consensus favors a halt to rate hikes in 2024, with a probable shift towards rate cuts in the first half of the year. However, skepticism surrounding this narrative could trigger sell-offs, especially among tech giants like Apple, Google, and Tesla.

Against this backdrop, some investors adopt a market-neutral stance, wary of overbought conditions and the consolidation of mega-cap stocks. Despite expectations of a continued rally, caution prevails, with projections suggesting resistance levels for the S&P 500 at $510-520. To provide a visual reference, the SPY Seasonal Chart is presented below:

In Thursday’s trading session, the S&P 500 soared to a new record high, buoyed by Powell’s testimony and declining Treasury yields. However, as markets await February’s employment report, uncertainties loom regarding job creation figures and the Fed’s future policy direction.

Looking ahead, the financial landscape remains dynamic, with earnings reports from Broadcom, Costco, and Gap poised to influence market sentiment. Amidst evolving economic narratives, investors brace for potential shifts in monetary policy and geopolitical tensions, navigating a landscape fraught with opportunities and challenges alike. With this in mind, one symbol comes to mind as a great play for the coming days.

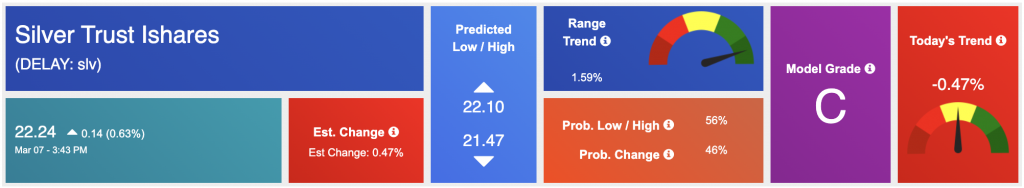

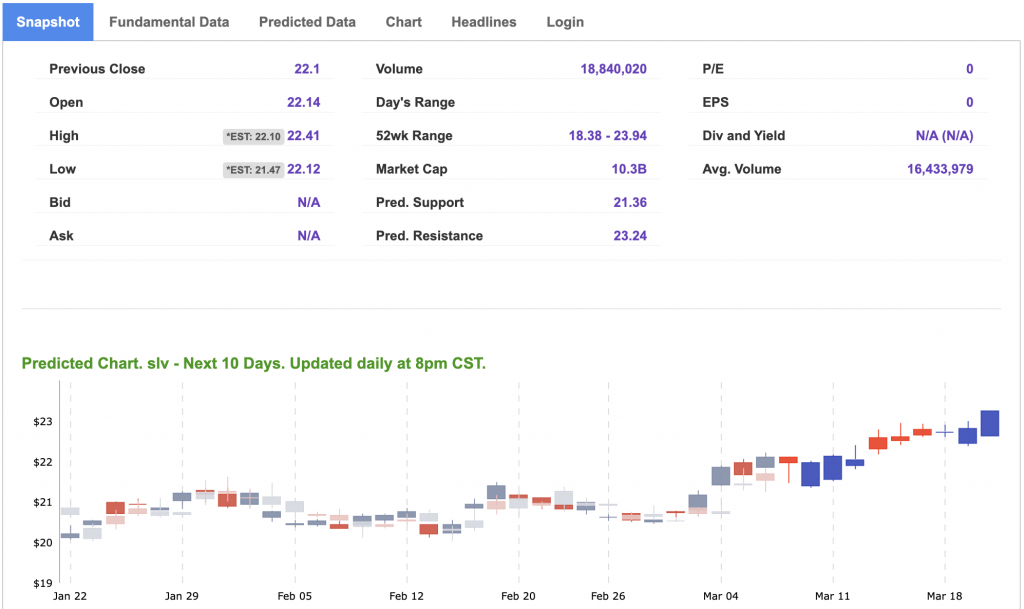

Silver Trust iShares (SLV) shines brightly within the commodities market, cherished for its industrial versatility and status as a precious metal. Its applications span diverse sectors, from electronics to renewable energy, underpinning its enduring demand.

As Federal Reserve Chairman Jerome Powell hints at potential interest-rate cuts to counter inflation, silver serves as a traditional hedge against rising prices. Its tangible nature makes it an appealing store of value in uncertain times. Despite market turbulence, silver benefits from its dual role as a precious metal and an industrial commodity. The ongoing global recovery fuels demand for silver in sectors ranging from manufacturing to green technologies, bolstering its intrinsic value.

Silver exhibits promising technical indicators, with its price potentially poised for an upward trajectory. Elevated interest rates and geopolitical tensions underscore silver’s appeal as a safe-haven asset, driving momentum in its favor. Beyond short-term fluctuations, silver’s long-term outlook remains positive. Structural shifts in supply and demand dynamics, coupled with ongoing technological advancements, underpin silver’s enduring utility and value proposition.

In summary, amidst inflationary pressures, monetary policy adjustments, and geopolitical uncertainties, silver (SLV) stands out as a compelling investment opportunity. Its intrinsic value, coupled with its role as an inflation hedge and portfolio diversifier, positions SLV as a beacon of stability in turbulent times. Investors seeking to navigate market volatility and capitalize on emerging trends would do well to consider silver as a cornerstone of their investment strategy.

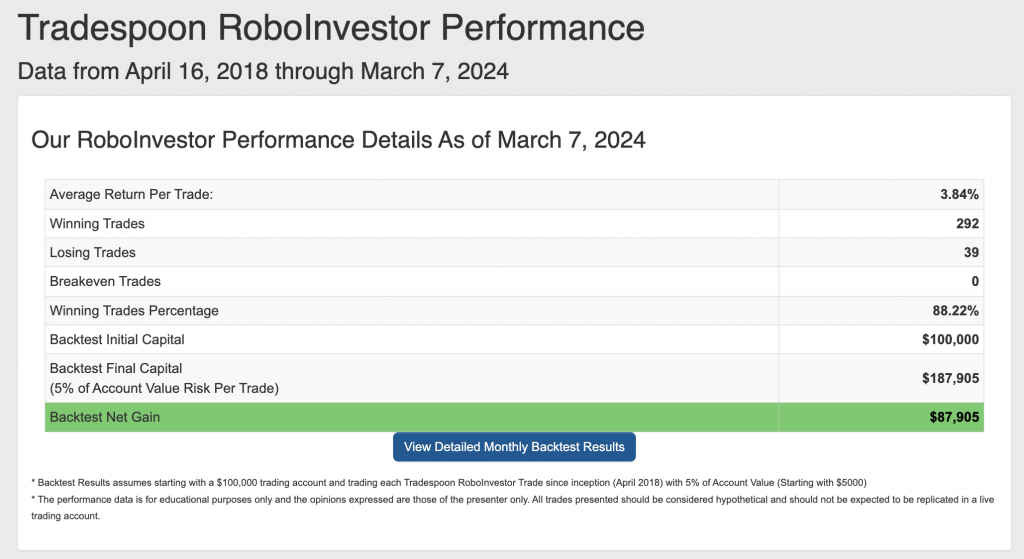

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.22% going back to April 2018.

As we step further into 2024, investors are confronted with a complex market scenario shaped by elements like inflationary forces, evolving Federal policies, and persistent geopolitical tensions, such as the ongoing conflict in Ukraine. Successfully maneuvering through this intricate landscape demands a dependable and well-informed investment platform. This is where RoboInvestor proves its worth, acting as a reliable ally by providing a spectrum of invaluable resources and expert guidance. With RoboInvestor at your service, you can adeptly oversee your portfolio and capitalize on lucrative opportunities within the dynamic and fast-paced market environment.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Click Here – To See Where I Put My RoboInvestor Money

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here To Subscribe To Our YouTube channel, Don’t Miss Out!

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Original source: https://www.tradespoon.com/blog/silver-shines-bright-why-slv-is-the-ultimate-investment-amidst-economic-turbulence/