Market Pulse: PCE Data Sparks Interest Rate Debate Amidst Sectoral Swings

RoboStreet – March 28, 2024

In a week characterized by intricate market movements and pivotal data releases, the spotlight fell squarely on the release of the Personal Consumption Expenditures (PCE) data, triggering a robust discourse on interest rates and reshaping investor strategies across sectors. Let’s delve deeper into the multifaceted narrative unfolding within the financial landscape.

The ebb and flow of the 10-year Treasury yield dominated headlines this week, as market participants closely monitored its retreat, igniting fervent speculation on the future trajectory of interest rates. Amidst this backdrop, value stocks surged ahead, buoyed by investor optimism surrounding a potential normalization of the yield curve and optimistic projections of diminishing inflationary pressures. However, the technology sector, epitomized by the struggles of stalwarts like NVDA, faced headwinds, underscoring the divergent fortunes within the market.

“I’m investing my own money in every stock my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Despite the sectoral oscillations, broader market indices, including the Dow Jones Industrial Average and S&P 500, etched record highs into the annals of market history. These milestones served as a testament to the underlying resilience of the market, defying earlier prognostications of imminent rate cuts. The Treasury yields, contrary to prevailing expectations, exhibited an overall upward trajectory, challenging conventional narratives and prompting a reassessment of market dynamics.

The market sentiment remained a complex tapestry woven with threads of optimism interwoven with strands of caution. Traders grappled with the nuanced probability of a June rate cut, with current odds hovering at an intriguing 69%. Yet, the specter of inflation loomed large, with the core PCE index forecasted to ascend by 2.8%, injecting a palpable degree of uncertainty into the equation and potentially reshaping the trajectory of future rate decisions.

Click Here To Subscribe To Our YouTube Channel, Don’t Miss Out!

In response to this nuanced landscape, investors adopted a spectrum of strategic positions, with a contingent opting for a neutral stance amidst the frothy market conditions and consolidation observed among heavyweight stocks. Against the backdrop of the impending Federal Reserve decision and the looming expiration of March options, strategic recalibration emerged as a paramount imperative, as investors endeavored to fortify their positions in anticipation of potential market gyrations.

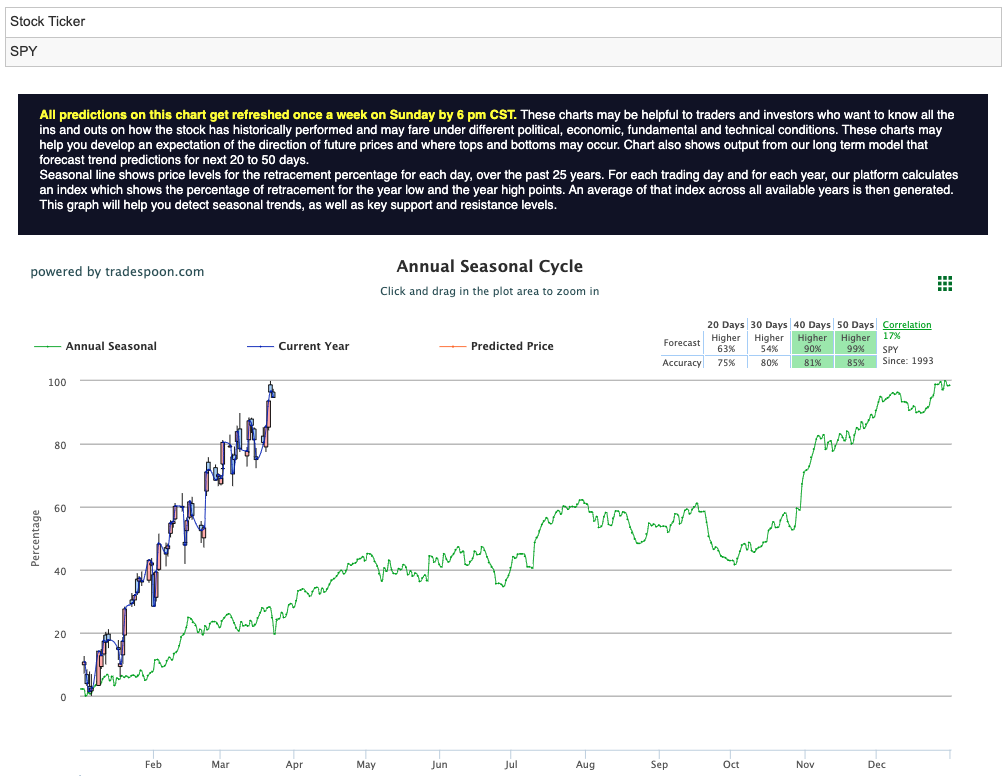

Looking ahead, market analysts chart a course characterized by cautious optimism and resilience. While patterns of higher highs and higher lows are anticipated, consensus suggests that the zenith of the rally may have passed. With the SPY rally likely constrained within the narrow confines of $510 to $525, and short-term support delineated at $480 to $490, investors remain steadfast in their vigilance, cognizant of the ever-evolving market landscape and poised to capitalize on emerging opportunities. For reference, the SPY Seasonal Chart is shown below:

As the market grapples with the reverberations of the PCE data release and eagerly awaits the pronouncements of the Federal Reserve, the journey ahead is laden with both promise and peril. Armed with insights gleaned from a panoply of economic indicators and central bank cues, investors stand resolute in their determination to navigate the labyrinthine corridors of uncertainty, leveraging strategic acumen and steadfast vigilance to navigate the undulating contours of the financial landscape and seize upon the latent opportunities that await amidst the flux. With this in mind, one symbol stands out.

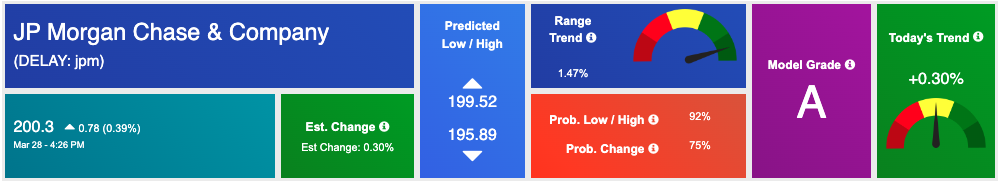

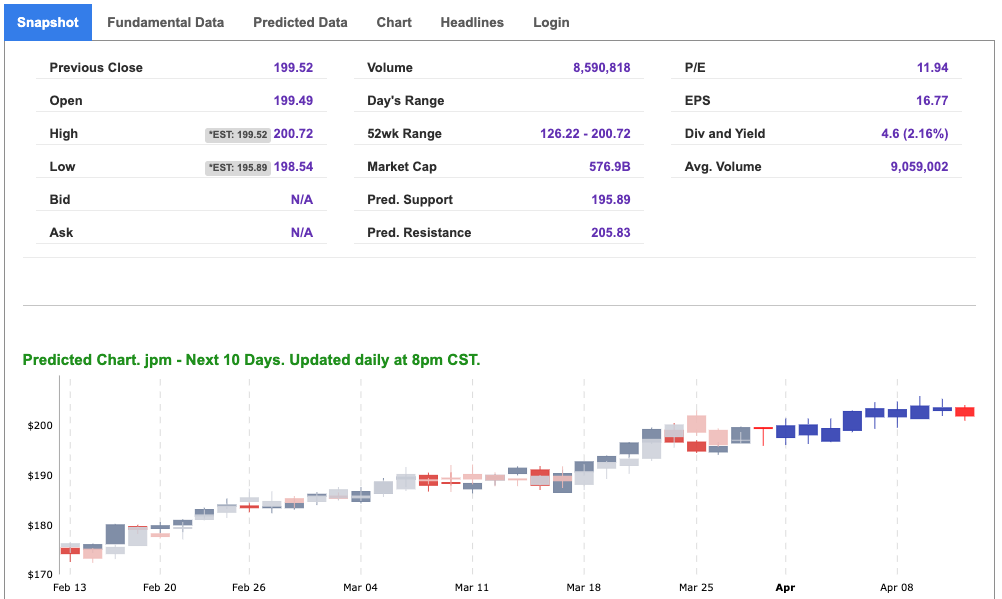

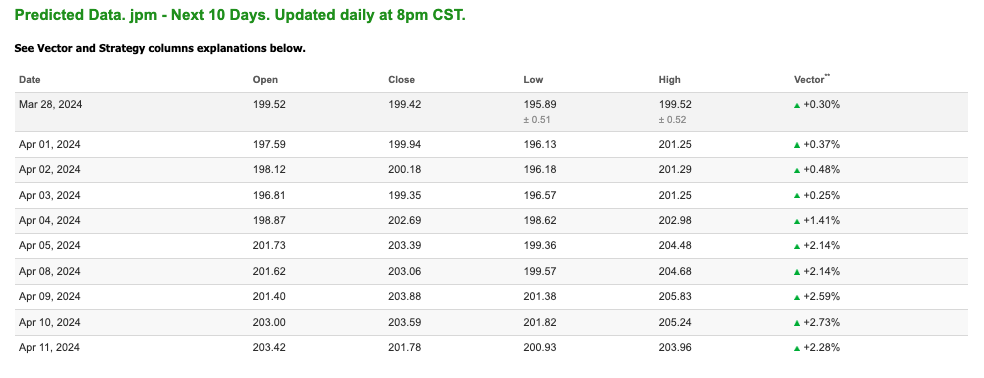

JPMorgan Chase & Co. (JPM) is a venerable institution within the financial services sector, boasting over a century of operational history. As one of the world’s largest and most diversified banking entities, JPMorgan Chase offers a comprehensive range of financial services, including investment banking, asset management, and consumer and commercial banking. Renowned for its robust risk management practices and innovative approach to finance, JPMorgan Chase has cemented its reputation as a cornerstone of the financial industry.

Why JPMorgan Chase & Co. (JPM) Presents a Compelling Investment Opportunity:

Amidst the current market landscape characterized by fluctuating Treasury yields, sectoral disparities, and cautious optimism, JPMorgan Chase emerges as an intriguing investment prospect for discerning investors.

Resilience Amidst Sectoral Swings: In an environment marked by sectoral turbulence, JPMorgan Chase has showcased resilience, leveraging its diversified business model to effectively navigate market headwinds. As a leading player in investment banking and asset management, JPMorgan Chase is well-positioned to capitalize on opportunities across various market segments, mitigating the impact of sector-specific challenges.

Beneficiary of Interest Rate Dynamics: With speculation surrounding interest rates and their implications for the financial sector, JPMorgan Chase stands to benefit from a potential normalization of the yield curve. Leveraging its robust risk management practices and extensive market expertise, JPMorgan Chase is poised to capitalize on evolving interest rate dynamics, thereby bolstering its revenue streams and enhancing shareholder value.

Strategic Market Positioning: Against the backdrop of broader market milestones and calculated projections, JPMorgan Chase’s strategic positioning augurs well for sustained growth and profitability. As the market anticipates potential rate adjustments and evaluates the impact of inflationary pressures, JPMorgan Chase’s prudent risk management strategies and forward-looking approach to finance provide a solid foundation for navigating market uncertainties and capitalizing on emerging opportunities.

Stability and Growth Potential: Amidst prevailing sentiment shifts and the nexus of uncertainty, JPMorgan Chase’s track record of stability and growth underscores its status as a reliable investment choice. With a robust balance sheet, diversified revenue streams, and a commitment to innovation, JPMorgan Chase is poised to weather market volatility while capitalizing on strategic initiatives to drive long-term value creation for its shareholders.

In conclusion, JPMorgan Chase & Co. (JPM) stands out as a compelling investment opportunity amidst the dynamic landscape of today’s financial markets. With its strong fundamentals, resilient business model, and strategic market positioning, JPMorgan Chase is primed to deliver sustainable growth and value creation, making it an attractive addition to investment portfolios seeking stability, growth, and resilience in uncertain times.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

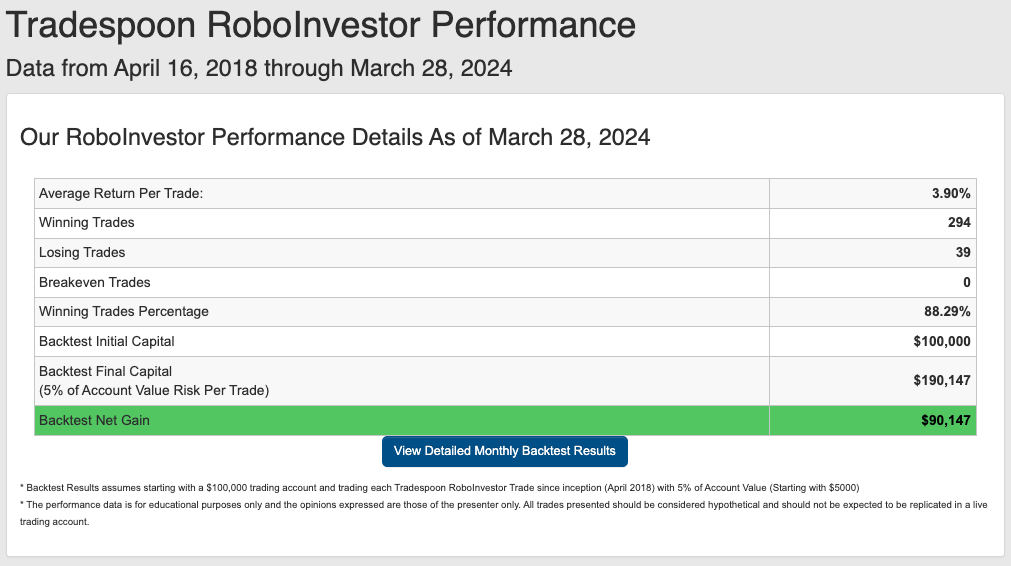

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.29% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Click Here – To See Where I Put My RoboInvestor Money

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Click Here To Subscribe To Our YouTube channel, Don’t Miss Out!

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Original source: https://www.tradespoon.com/blog/unveiling-the-financial-powerhouse-why-jpmorgan-chase-jpm-is-the-investment-gem-of-2024/