In today’s dynamic financial realm, the fusion of artificial intelligence (AI) has reshaped trading methodologies. Tradespoon’s innovative AI algorithmic trading platform, driven by sophisticated algorithms and cutting-edge machine learning methods, stands as a beacon of modern trading strategies. Join us as we explore the multifaceted world of AI algorithmic trading, unraveling the diverse array of trading algorithms, and assessing their profound impact on contemporary trading landscapes.

The Evolution of Algorithmic Trading through AI

The integration of artificial intelligence (AI) has ushered in a revolutionary era in algorithmic trading, reshaping the very fabric of how financial markets operate. Unlike traditional trading methods, which relied heavily on human intuition and manual analysis, AI-driven algorithms have introduced a paradigm shift by leveraging advanced computational techniques to process vast amounts of data, discern complex patterns, and execute trades with unprecedented speed and accuracy.

At the heart of this transformation lies the concept of algorithmic trading, where AI algorithms play a pivotal role in automating the decision-making process. By harnessing the power of machine learning, natural language processing, and other AI technologies, these algorithms can analyze market data in real-time, identify subtle signals, and execute trades at lightning-fast speeds, all without human intervention.

The evolution of algorithmic trading through AI can be traced back to the early days of electronic trading, where the advent of computers paved the way for automated trading strategies. Initially, these strategies were simple rule-based systems that executed trades based on predefined conditions. However, with the advancement of AI technologies, algorithmic trading has evolved into a sophisticated ecosystem, encompassing a diverse array of algorithms tailored to address specific trading objectives.

Today, AI algorithms power a wide range of trading strategies, from high-frequency trading (HFT) algorithms that exploit microsecond price differentials to sentiment analysis-based algorithms that gauge market sentiment from social media feeds and news articles. These algorithms continuously learn from historical data, adapt to changing market conditions, and optimize trading performance over time, enabling traders to stay ahead of the curve in an increasingly competitive landscape. Moreover, the democratization of AI technology has democratized access to algorithmic trading, leveling the playing field for traders of all levels with the rise of AI-powered trading platforms and educational resources, providing individual traders access to cutting-edge tools and insights once reserved for institutional investors.

Diverse Facets of AI Algorithmic Trading

AI algorithmic trading encompasses a spectrum of algorithms, each tailored to address specific trading needs:

- Rule-Based Trading Algorithms: These algorithms operate on preset conditions, automatically executing trades based on defined criteria such as price movements or technical indicators.

- Machine Learning-Based Trading Algorithms: Utilizing historical market data, these algorithms identify patterns and trends, continuously adapting to market dynamics to enhance trading performance over time.

- Neural Networks in Algorithmic Trading: Mimicking the human brain’s structure and function, neural networks excel in recognizing complex patterns and making predictions, thereby aiding traders in anticipating market trends.

- High-Frequency Trading (HFT) Algorithms: Executing trades at lightning speeds, HFT algorithms capitalize on minute price differentials and arbitrage opportunities, leveraging advanced algorithms and low-latency infrastructure.

- Sentiment Analysis-Based Trading: These algorithms gauge market sentiment by analyzing textual data from various sources, enabling traders to make informed decisions based on prevailing market sentiment.

- Genetic Algorithms in Trading: Using principles of natural selection, genetic algorithms evolve trading strategies through successive iterations, optimizing parameters to adapt to changing market conditions.

- Arbitrage Opportunities with AI: Identifying and exploiting price discrepancies across markets, these algorithms execute trades swiftly to capture profits from arbitrage opportunities.

- Portfolio Management Algorithms: Optimizing portfolio allocation and rebalancing, these algorithms aim to maximize returns while minimizing risk, based on predefined risk preferences and return objectives.

- Automated Execution Systems: These systems execute trades automatically according to predefined rules, eliminating human error and emotion from the trading process.

- Hybrid Approach (Integration of Multiple AI Techniques): Combining various AI techniques, hybrid approaches create robust and adaptive trading systems, enhancing trading performance and accuracy.

Benefits Redefined: AI Algorithmic Trading

The integration of AI algorithmic trading yields a spectrum of advantages that redefine trading dynamics:

- Enhanced Efficiency: AI algorithms revolutionize data processing capabilities, swiftly handling massive datasets and executing trades with remarkable speed, thus optimizing trading operations and overall efficiency.

- Augmented Accuracy: Machine learning algorithms delve deep into historical market data, meticulously identifying nuanced patterns and trends with precision, thereby empowering traders to make informed decisions grounded in comprehensive market insights.

- Elevated Profitability: AI-driven strategies dynamically adapt to evolving market conditions, adeptly identifying profitable opportunities and strategically optimizing trading approaches to maximize returns, thus elevating overall trading profitability.

- Adaptive Learning: Neural networks and other AI models continuously evolve and refine their trading strategies through adaptive learning mechanisms, assimilating new market data to enhance predictive capabilities and improve trading performance over time, fostering a continuous cycle of learning and improvement.

Challenges and Risks: Navigating the Terrain

However, amidst the myriad benefits, AI algorithmic trading presents a host of challenges that require vigilant navigation:

- Data Quality: The effectiveness of AI algorithms critically depends on the quality and integrity of input data, necessitating rigorous data validation and cleansing processes to ensure accurate and reliable predictions and insights.

- Overfitting: Machine learning models are susceptible to overfitting, wherein they excessively tailor themselves to historical data patterns, potentially leading to diminished performance when applied to unseen data, thus highlighting the importance of robust model validation and regularization techniques to mitigate overfitting risks.

- Regulatory Compliance: The proliferation of AI-driven trading strategies raises regulatory concerns surrounding transparency, fairness, and the potential for market manipulation, necessitating adherence to stringent regulatory frameworks and ethical guidelines to uphold market integrity and investor trust, thus emphasizing the importance of proactive compliance measures and regulatory oversight in ensuring ethical and responsible AI algorithmic trading practices.

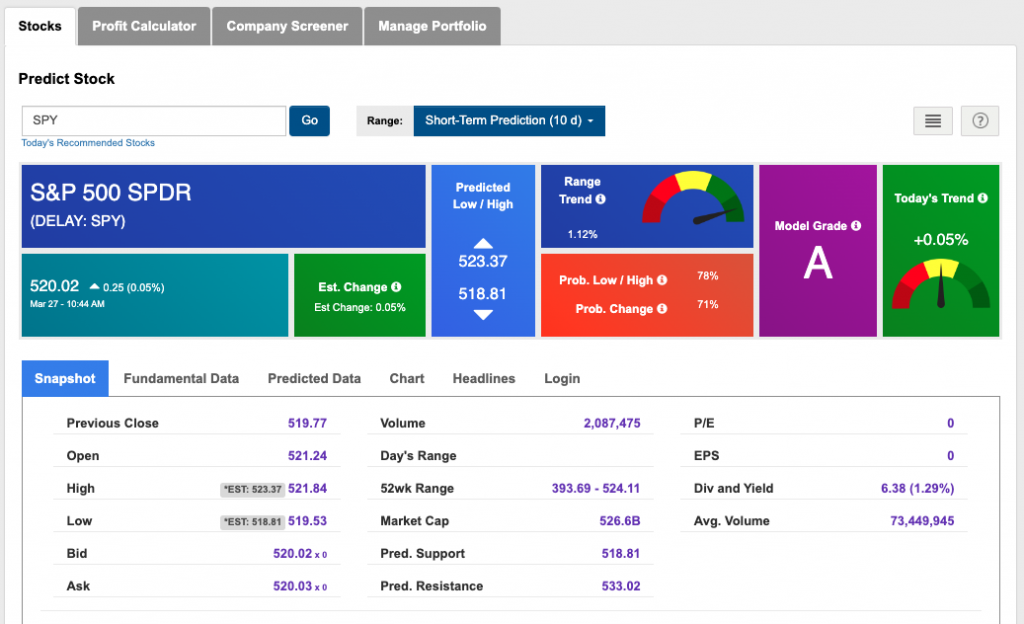

Tradespoon’s AI Trading Toolbox: A Comprehensive Review

Tradespoon offers a comprehensive suite of AI trading tools and resources designed to empower traders with the latest advancements in AI algorithmic trading. From predictive analytics to risk management solutions, Tradespoon equips traders with the knowledge and technology needed to navigate today’s dynamic markets effectively.

Culmination: Transformative Insights

AI algorithmic trading marks a paradigm shift in the evolution of financial markets, offering unparalleled opportunities for traders to capitalize on market inefficiencies and generate alpha. Embracing AI algorithmic trading is essential for staying ahead of the curve and achieving long-term success in trading.

FAQ

- What is the future outlook for AI algorithmic trading?

The future outlook for AI algorithmic trading is promising, with continued advancements expected to enhance trading strategies and performance. As AI algorithms become more sophisticated and accessible, broader adoption among traders is anticipated.

- How can traders stay informed about the latest trends in AI algorithmic trading?

Traders can stay informed by following reputable sources such as industry publications, research papers, and conferences focused on AI and finance. Additionally, leveraging educational resources and networking with experts can provide valuable insights.

- Is AI algorithmic trading accessible to individual traders or mainly institutional investors?

AI algorithmic trading is increasingly accessible to both individual traders and institutional investors. With platforms like Tradespoon democratizing access to AI technology, traders of all levels can leverage its benefits in their trading strategies.

- How can beginners start learning about AI algorithmic trading?

Beginners can start by gaining a foundational understanding of trading principles and AI concepts. Educational platforms like Tradespoon offer comprehensive learning materials tailored to beginners, enabling them to gradually build knowledge and skills through practical application.

By embracing Tradespoon’s AI algorithmic trading platform, traders can embark on a transformative journey, equipped with the tools and insights needed to thrive in today’s ever-evolving financial markets.

Join the Tradespoon Trading Community for Enhanced Day Trading

Becoming a member of the Tradespoon trading community can significantly support your trading endeavors. Our carefully crafted community offers an unparalleled trading experience, enabling you to leverage our impartial AI trading program and gain valuable knowledge from accomplished traders. By joining us, you will immerse yourself in a supportive environment that fosters growth and provides access to a wealth of expertise.

With the market’s unpredictable nature and the uncertainty that lies ahead, we cannot stress enough the importance for our readers and members of the Tradespoon community to refer to our Live Trading Room. By doing so, you can stay updated on how our AI platform navigates select trades and gain valuable insights throughout the trading day. Our Live Trading Room is available for free, and we highly encourage everyone to sign up and check in regularly.

For more information on Tradespoon’s tools and our trading community, we recommend reviewing our latest Strategy Roundtable, held weekly on Tradespoon.

Being part of our Tradespoon trading community is immensely advantageous; here, you can exchange multiple tactics with fellow traders. During my recent Strategy Roundtable session (which is held weekly on Tradespoon), we did just that! This opportunity to collaborate and learn from others in the world of trading should not be passed up. I recommend checking out our latest Roundtable webinar in its entirety below:

Tradespoon Strategy Roundtable

Join us and unlock your trading potential with Tradespoon today!

Original source: https://www.tradespoon.com/blog/revolutionizing-trading-with-tradespoons-ai-algorithms-unveiling-advanced-techniques/